Laptop Table Hsn Code Gst Rate

The GST Rate HSN codes and rates have been arranged as per the best of authors understanding and are subject to periodic updates as per the law for the time being in force. You have to only type name or few words or products and our server will search details for you.

Pin On Invitations Stationery Illustration

Now from Gateway of Tally Select Voucher Press F8 or Click on Sale voucher Now you will see two new columns in sale voucher one for HSN code and another one is for IGST rate Put IGST rate and then select the CGST and SGST to define GST on invoice and rate will be calculated automatically as shown on the image below.

Laptop table hsn code gst rate. It does not constitute professional advice or a formal recommendation. GST rates for all HS codes. Tax rates are sourced from GST.

HSN Code for Computers Laptops. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Other. Revolving Chair Computer Table Massage Chair.

LAPTOP BAG 15 SPARES ACCESSORIES FOR LAPTOP NON REPUTED BRAND QTY 800PCS 2USDPCS China. Shoe polish furniture wax and floor waxes polishes and creams for coachwork glass or metal scouring pastes and powders and similar preparations whether or not in the form of paper wadding felt nonwovens sponge plastics cellular plastics or cellular rubber impregnated coated or covered with such preparations excluding artificial and prepared waxes of heading 3404. GST rates for all HS codes.

All around the world same HS codes are used to discribe a product. HS Code is internationally accepted format of coding to describe a product. Tax rates are sourced from GST.

While due care has been taken in preparing this content the existence of mistakes and omissions herein is not ruled out. What is HS Code. HS Code Description Origin Country Port of Discharge Unit Quantity Value INR Per Unit INR Nov 21 2016.

OTHER WOODEN FURNITURE USED IN BEDROOM Products Include. Once the HSN code is determined then the GST rate can be determined easily. This App provide you Correct HSN codes and Rates of Product given by Government.

Mobile Phones Telephones for cellular networks or for other wireless networks 6. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. LAPTOP BAG 14 SPARES ACCESSORIES FOR LAPTOP NON REPUTED BRAND.

Desktop Other Personal. The four digit HSN code for computers is 8471. Charger Electrical transformers static converters for example rectifiers and inductors other than charger or charging station for Electrically operated vehicles 9.

Trunks suit-cases vanity-cases executive-cases brief-cases school satchels spectacle cases binocular cases camera cases musical instrument cases gun cases holsters and similar containers. GST rate for HSN Code 8471 is 18. Chapter 94 - Furniture Bedding Cushions Lamps and Lighting Fittings Illuminated Signs Name-plates Prefabricated Buildings.

HSN Code Product Description Import Data Export Data. You have to only type name or few words or products and our server will search details for you. Tempered Glass Screen Protector.

You can use 4 digit HS code to generate your invoices. All around the world same HS codes are used to discribe a product. HS Code is internationally accepted format of coding to describe a product.

The four digit HSN code for computers is 8471 and according to this HSN code 18 GST rate is applicable on Computers. Mobile Mobile Accessories. Search Functionality for search code.

HS Code Description GST 16056300. Iron Or Steel Wool. Chapter 84 of the HSN defines the HSN code for personal computers micro-computers and laptops under the heading Automatic Data Processing Machines and Units.

HSN code for personal computers laptops micro-computers are classified under Chapter 84 of the HSN under heading Automatic Data Processing Machines and Units. What is HS Code. You can search GST tax rate for all products in this search box.

HSN Code Chapter Description Rate Cess 9401. 19 lignes Find GST Rate HSN Code Search. GST RATE WITH HSN CODE TDL FREE DOWNLOAD link WITH NEW UPDATED DOWNLOAD LINK httpsgooglforms8Q1zR9UlexoayUTg1you can download this file from this link.

Of Iron Other Than Cast Iron. Travelling-bags insulated food or beverages bags toilet bags rucksacks handbags shopping-bags wallets purses map-cases cigarette. Other furniture and parts thereof.

Seats other than those of heading 9402 whether or not convertible into beds and parts thereof. HSN Code ITEM CGST Rate SGST UTGST Rate IGST Rate 8517. Provide Rate wise list of HSN and Service codes.

You can use 4 digit HS code to generate your invoices. You can search GST tax rate for all products in this search box. Tax2win will not be held.

Medical surgical dental or veterinary furniture for. HSN Code Product Description Import Data Export Data.

Hsn Code Gst Rate For Electrical And Electronic Products Chapter 85 Tax2win

How To Calculate The Landed Cost Of Imported Products Incodocs

Wooden Black Callas Multipurpose Foldable Laptop Table With Cup Holder Id 21871454555

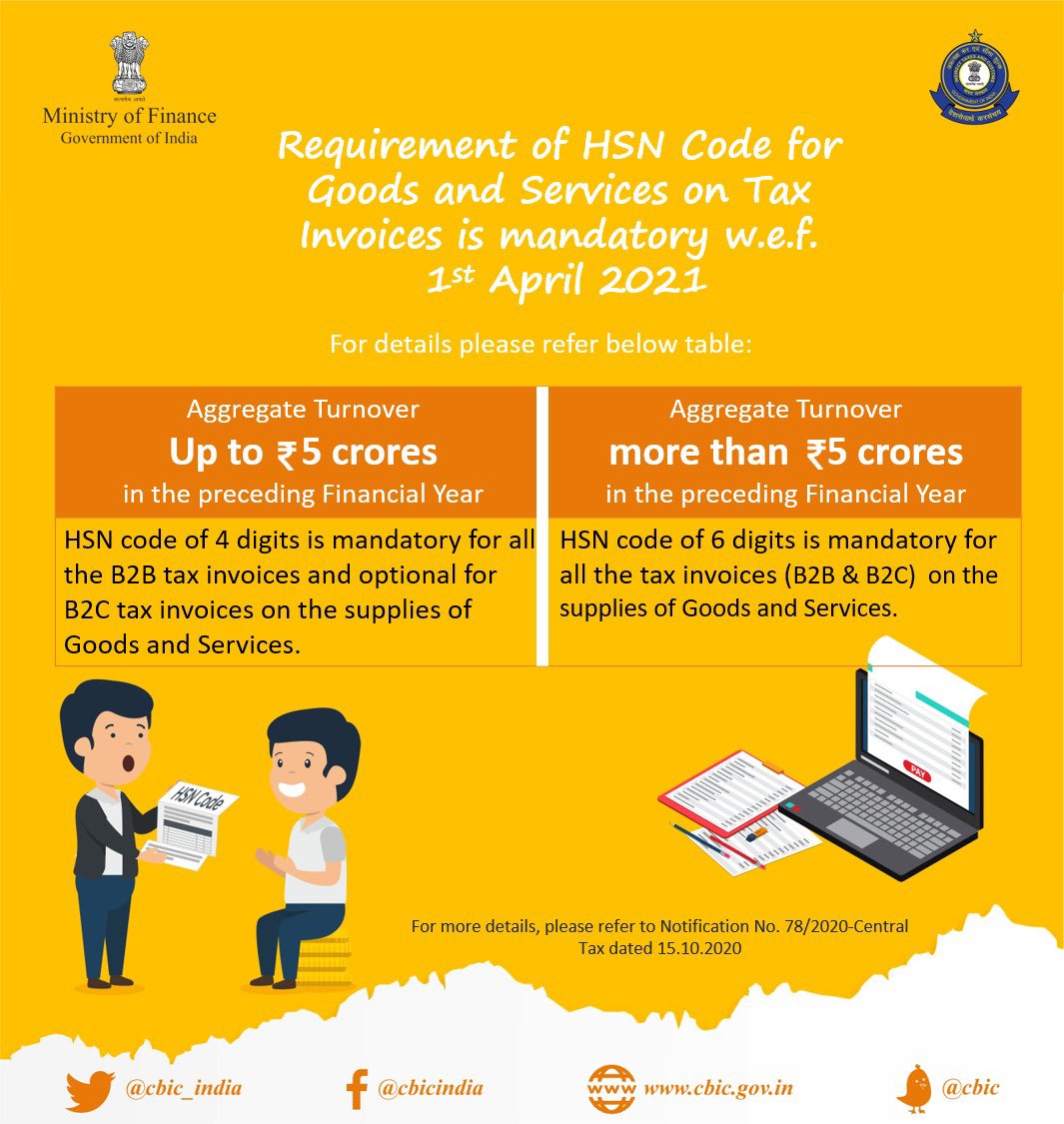

Cbic On Twitter Attention Gst Taxpayers Requirement Of Hsn Code For Goods And Services Tax Is Mandatory W E F April 01 2021

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021

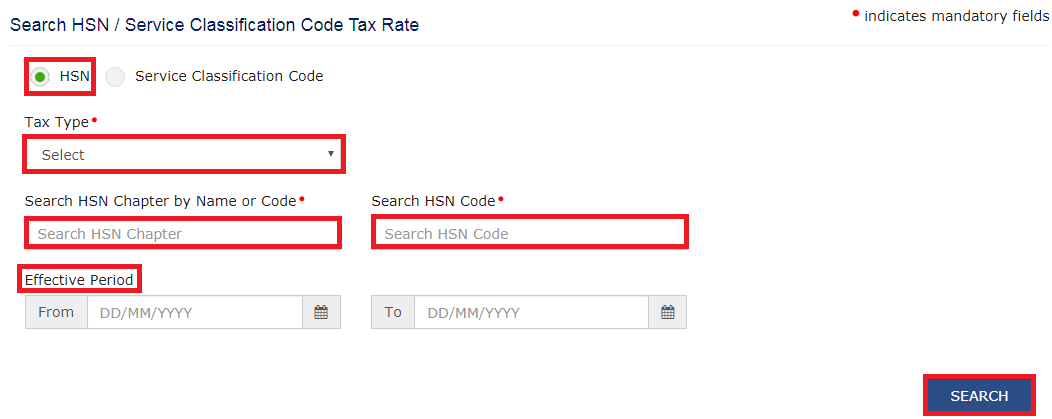

Gst Portal Search Hsn Sac Tax Rates Learn By Quicko

Hsn Code For Computer And Laptops With Gst Rate Indiafilings

Brown Wooden Laptop Table With Mobile Dock Anything N Everything Retail Id 21706412730

Printing Hsn Sac In Your Invoice

Delhi Gst Officials Declare 4 6 Digits Hsn Code For Aggregate T O In Fy 2021 22

Hp Laptop 14s Cf3028tu Hp Store India

Printing Hsn Sac In Your Invoice

Printing Hsn Sac In Your Invoice

How To Calculate Gst On Laptops And Computers In India

Portable Laptop Stand At Rs 1999 Piece Laptop Stands Id 22574889048

How To Record Sales Under Gst In Tallyprime Tallyhelp

Gst Rates On Computer Laptops With Accessories Sag Infotech

Find Gst Rate Hsn Code Or Sac Code For Indiafilings Com Facebook

Post a Comment for "Laptop Table Hsn Code Gst Rate"